Calculating Quarterly Taxes as a Freelancer

Calculating your taxes as a freelancer can be a daunting task. Often times we don't know exactly how much we will make come year end. If you overpay early in the year, it can leave you short on cash at the end, with no refund until the following year. What's a freelancer to do?

This was one of the major reasons I built fin. It helps you forecast your contracts against your expenses to see the reality of where you will end up.

Important note, this is does not constitute financial advice. The exact amount you will owe for taxation is based on many factors so ultimately you should review this with your accountant.

For those that don't want to read on, I made a video showcasing this below:

Let's say that I sign a 6 month contract here in January for $12,000.00 per month. When it comes time to compute my taxes for quarter one in April, my accountant typically assumes this to be a steady trend throughout the year. Therefore, I would compute my quarterly tax burden based on the net income of $36,000.00.

I'll add this income to Fin and take a look at the cumulative vs. month over month recurring revenue.

The obvious first problem here is that I'm not taking into account any expenses, which is easy enough to remedy by tracking and deducting those from my total income.

I'll add some expenses to my freelance practice and we can now see how this lays out for quarter one.

With our expenses added we can say that we should plan to pay quarterly taxes on an income of $30,276.60. But what if we fail to secure another contract in July?

Therin lies the problem with calculating our taxes this way. Using fin we can see how the next 12 months of our future looks if we fail to sign any new customers.

We end the year with a profit of $49,106.40 far below our expectations when we cut a check for quarter one. This is the fear of every freelancer, we don't want to overpay our quarterly taxes and end up short on cash at the end of the year if we fail to secure another contract.

In 2024 this was a reality for many as tech contracts dried up and work became harder to secure. With Fin, we can see further into the future and assess our risks accordingly.

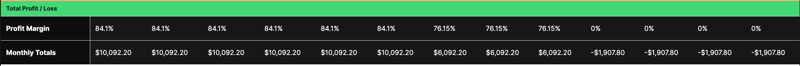

Now let's say we secure a contract for July through September but at a lower monthly rate of $8,000.00 per month. This changes our month over month projection to look more like this:

We can see a bit further into the future now but there's still a real risk we sign no contracts at the end of the year. Now we can see this and take a look at what our 12 month is instead of what it looks like at that point in time.

You can also see that come October we're going to need to begin dipping into our harvested profits to cover our ongoing expenses.

Ultimately, if we hold some cash back and use our 12-month net profit projection come June, we can cover the downside nicely should we hit a dry spell in terms of work. Otherwise we'd be forced to leverage credit cards and rely on a tax refund the following year to make up for the cash shortage.